After a strong first quarter, the Spanish real estate market continues to perform well in the second quarter of 2025. With an average price increase of almost 10% year-on-year and a solid recovery in the mortgage market, buyer confidence appears to be growing further. Once again, the largest price increases are seen in Madrid, on the islands and along the popular coastlines. Read all about it in the Spain Real Estate Market Analysis 2025 Q2.

General situation real estate market Spain in 2025 Q2

In the second quarter of 2025, the average house price in Spain rose by 2.6% compared to the previous quarter and by 9.8% compared to the same quarter a year earlier. Adjusted for inflation, this represents a real price increase of 7.7%.

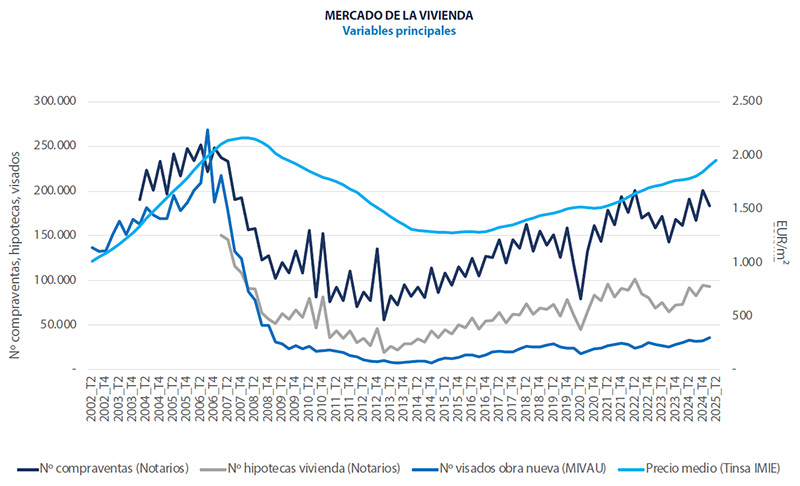

Demand for owner-occupied homes remains robust. In the first half of the year, the number of transactions rose sharply: +10.3% according to notaries and +15.9% according to the Spanish statistics agency (INE). The mortgage market also recovered remarkably, with an increase in the number of new mortgages of +22.1% (notaries) and +25.1% (INE) respectively. More than half of the residential transactions during this period were financed with a mortgage.

On the supply side, we see mixed signals: the number of new building permits increased by +19.4%, but the number of homes actually completed fell by -7.9%, which does not alleviate the shortage of new homes for the time being.

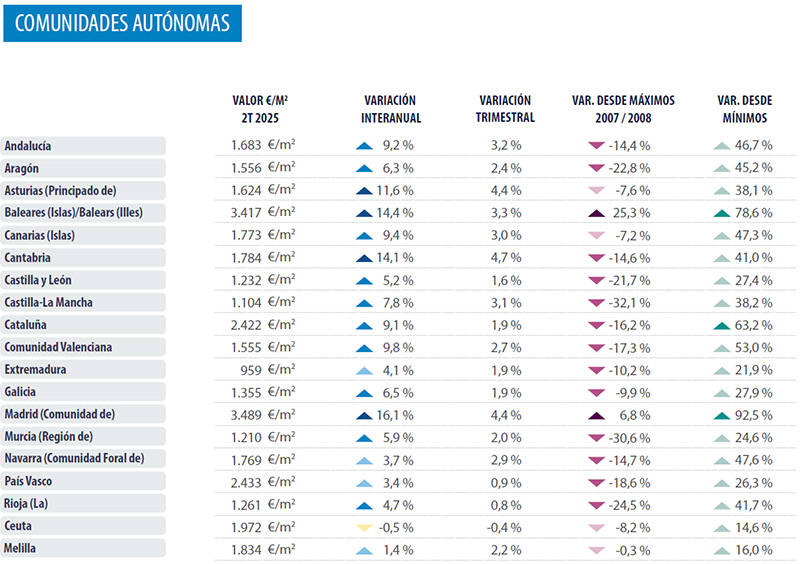

Property prices in Spain by autonomous region

House prices rose in almost all regions, with the increase accelerating in 16 of the 19 autonomous regions compared to Q1. The largest increases were seen in:

- Madrid and the Balearic Islands: above +10%.

- Comunidad Valenciana, Canary Islands, Andalusia and Catalonia: increases between +9% and +10%.

These regions generally combine their price levels with a favourable location by the sea or near large cities, which makes them attractive to foreign buyers.

Most regions are still below their 2007/2008 peak in terms of price, which means there is still room for further growth. Only Madrid and the Balearic Islands have now exceeded their nominal record prices.

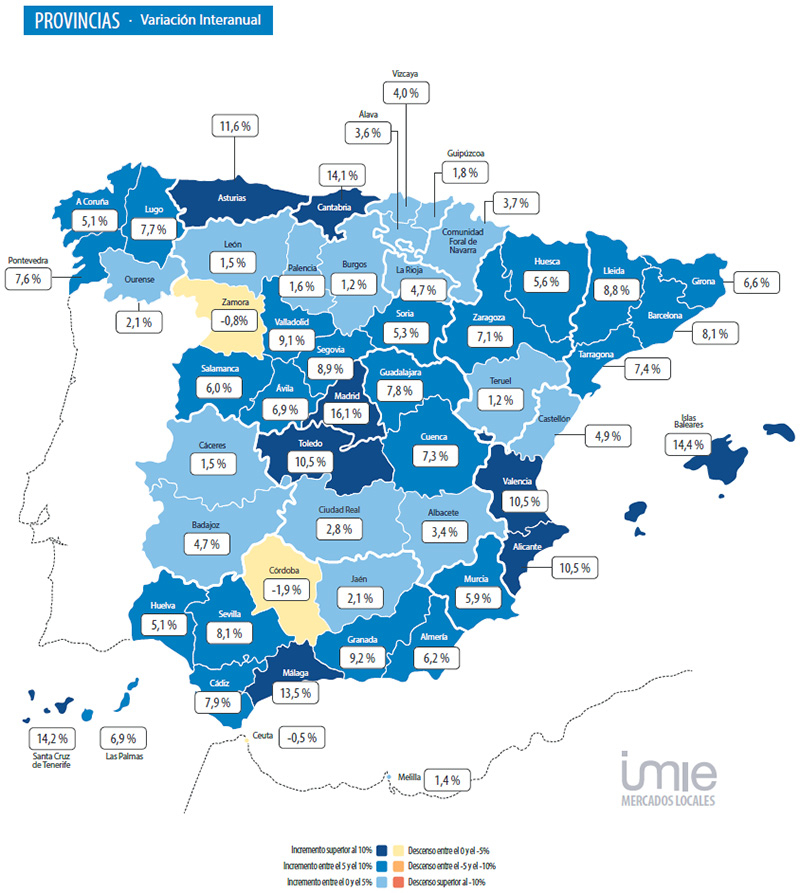

Property prices in Spain by province

The provincial figures clearly show that coastal areas and urban regions are driving growth. The highest year-on-year price increases (>10%) can be seen in:

- Madrid (+16.1%)

- Balearic Islands (+14.4%)

- Santa Cruz de Tenerife (+14.2%)

- Málaga (+13.5%)

- Valencia, Alicante (both +10.5%)

In total, 24 provinces saw quarterly growth of more than 2%. Within the regions where we operate, the Costa Blanca (Valencia and Alicante) and the Costa del Sol (Málaga) stand out as growth engines, partly due to their appeal to international buyers.

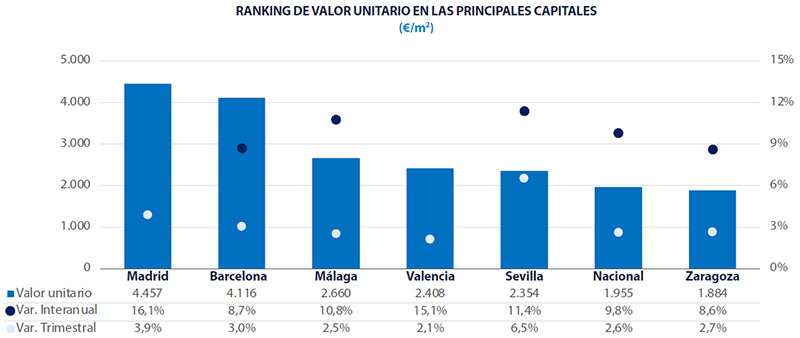

Real Estate Prices in the Major Cities of Spain

House prices in major Spanish cities have risen sharply once again. Thirty-four cities saw price increases of more than 5%, compared to 28 in the previous quarter. The biggest outliers included:

- Madrid, Valencia, Palma de Mallorca, Seville, Alicante and Málaga – all with annual increases of over +10%.

- Other cities with increases between 8% and 10% include Barcelona and Granada.

On a quarterly basis, Seville recorded the largest jump (+6.5%).

In nominal terms, four cities are now more expensive than ever: Madrid, Palma de Mallorca, Málaga and Santa Cruz de Tenerife. Adjusted for inflation, prices are still slightly below their historic peak.

What is striking is that cities such as Valencia, Seville and Málaga still combine relatively affordable prices with above-average growth. For buyers or investors who want to stay below the prices of Madrid and Barcelona, these cities offer an excellent alternative.

Conclusion Real Estate Market Spain 2025 Q2

The Spanish property market remains dynamic, with prices rising in almost all regions. The combination of increasing mortgage availability, an improving economy and limited supply continues to put pressure on house prices. Price growth is particularly strong in urban and tourist areas.

For investors and buyers with a long-term vision, there are still plenty of opportunities, especially in regions where prices have not yet reached their historic highs or where economic dynamics are strong. This applies, among others, to the regions of: Comunidad Valenciana (including the city of Valencia and the Costa Blanca), Andalusia (including the Costa del Sol), Catalonia, Madrid, the Canary Islands and the Balearic Islands. In all these areas, we are seeing strong price increases, but also interesting opportunities for those looking for a (second) home or investment in Spain.

Would you like to know more about investing in Spain or which regions best suit your needs? Contact us and our team will be happy to help you.

Source: TINSA