The year starts well as the Spanish property market continues to show signs of growth, despite global economic fluctuations. With limited supply and strong demand, property prices continue to rise, especially in tourist areas and employment-rich regions. In this article, we look at the main price trends at national and regional level, based on the latest figures from the analysis real estate market Spain 2025 Q1.

General situation real estate market Spain in 2025 Q1

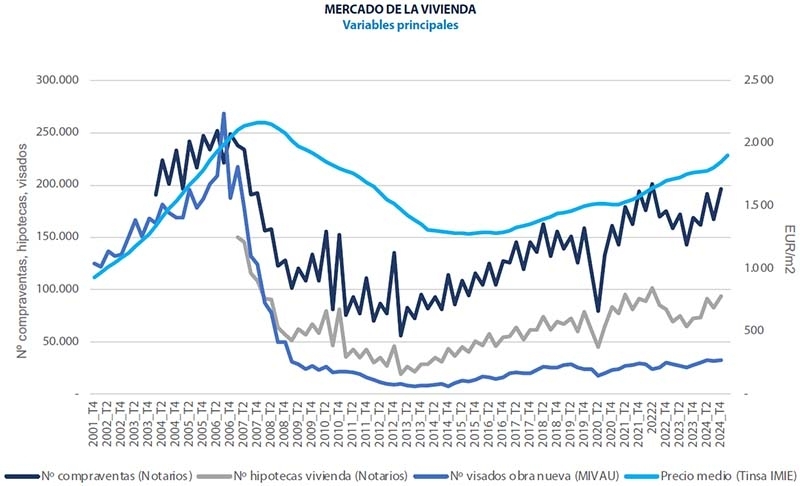

In the first quarter of 2025, the average price of existing and new-build homes rose 7.5% from a year earlier and 2.9% from the previous quarter. If we exclude inflation, the actual price increase comes to 4.7% year-on-year. This means that house prices in Spain are again rising faster than in the previous quarter.

The European Central Bank’s 2024 interest rate cuts have made it easier to get a mortgage. However, almost half of homes are still bought without a mortgage.

The construction sector continues to struggle to meet demand. In January, the number of new homes completed remained almost the same as last year (-0.4%), according to the Ministry of Housing. This is mainly due to the shortage of building land in sought-after areas, further fuelling the rise in house prices.

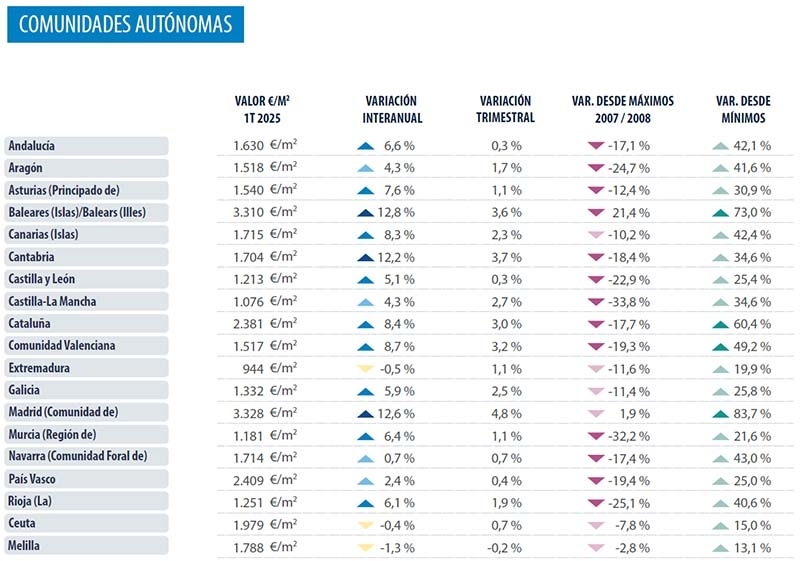

Property prices in Spain by autonomous region

House prices continue to rise in most regions. In 18 of the 19 autonomous regions, annual growth is accelerating or remaining at the same level. On a quarterly basis, almost all regions are showing an increase. Madrid and Catalonia stand out in particular, where annual price growth is almost double that of the previous quarter.

Compared to a year ago, prices rose by more than 3% in most regions. Most price increases are between 4% and 9%, but in the Balearic Islands (+12.8%) and Madrid (+12.6%), among others, growth is even above 12%. The autonomous regions of Comunidad Valenciana (+8.7%), Catalonia (+8.4%) and the Canary Islands (+8.3%) also stand out with their annual price increases.

Most regions also show growth on a quarterly basis. In 8 of the 19 regions, this growth is moderate and ranges between 0% and 1.5%. The strongest increases are measured in Madrid (+4.8%), the Balearic Islands (+3.6%), Comunidad Valenciana (+3.2%) and Catalonia (+3.0%). There are no significant price decreases.

House prices continue to move further away from the lowest levels reached during the economic crisis. The regions furthest away from this are Madrid, the Balearic Islands, Catalonia and Comunidad Valenciana.

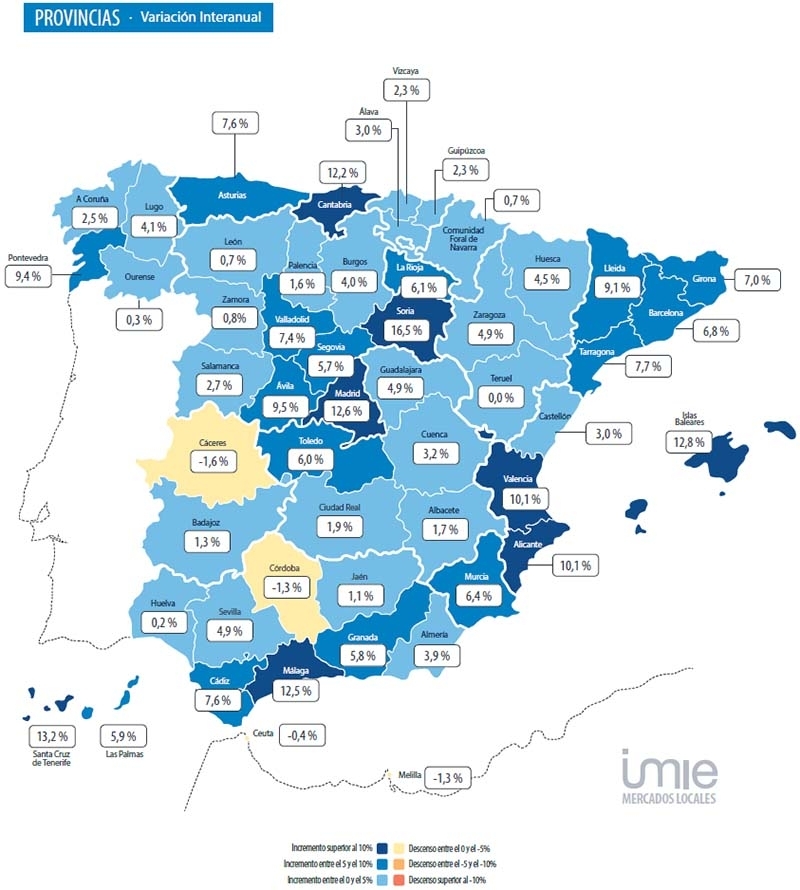

Property prices in Spain by province

House prices are rising in almost all provinces, both on the coast and inland. The biggest price rises are taking place along the entire coastline (north, Mediterranean and Atlantic coasts) and in major inland working areas, with Madrid being the outlier.

On an annual basis, price increases vary by province between -1.6% and +16.5%. The strongest increases, above 10%, are measured in Santa Cruz de Tenerife (+13.2%), the Balearic Islands (+12.8%), Madrid (+12.6%), Málaga (+12.5%), Alicante (+10.1%) and Valencia (+10.1%), among others.

On a quarterly basis, 18 provinces show price increases of more than 2%, while 17 provinces show stable prices (+/- 1%). The strongest growth was seen in Madrid and Valencia, among others, where prices rose by more than 4%. Growth is also between 3% and 4% in the Balearic Islands, Santa Cruz de Tenerife, Tarragona and Alicante.

Growth is remarkably strong in the main economic centres. In the province of Madrid, house prices are up +12.6% year-on-year (compared to +7.0% in the previous quarter) and +4.8% quarter-on-quarter (previously +3.9%). Barcelona is also showing strong growth with +6.8% year-on-year (previously +4.2%) and +2.1% quarter-on-quarter (previously +1.1%).

Within some autonomous regions, there are big differences between provinces:

- In Andalusia, prices are rising strongly in Málaga and Cadiz, while growth is more moderate in Granada, Seville and Almería.

- In the Canary Islands, prices are rising much faster in Santa Cruz de Tenerife than in Las Palmas.

- In the Comunidad Valenciana, Valencia and Alicante are the strongest risers.

The top three most expensive provinces in Spain to buy a property are currently:

- Madrid (€3,328/m²)

- Balearic Islands (€3,310/m²)

- Barcelona (€2,682/m²)

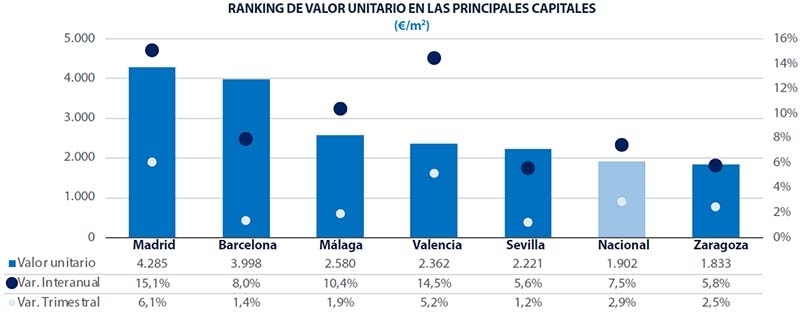

Real Estate Prices in the Major Cities of Spain

House prices in most Spanish cities have risen sharply, especially in coastal cities, economic centres and smaller capitals close to major activity.

On an annual basis, price changes range between -1.3% and +15.1%, with almost all cities showing an increase. A total of 28 capital cities have a price increase of more than 5%, up from 22 in the previous quarter.

The cities with the largest price increases of more than 13% over the past year include: Madrid (+15.1%), Valencia (+14.5%) and Palma de Mallorca (+13.3%). Other strong increases include Málaga (+10.4%), Santa Cruz de Tenerife (+10.3%), Alicante (+10.1) and Barcelona (+8%).

Conclusion Real Estate Market Spain 2025 Q1

The Spanish real estate market will continue to grow strongly in 2025, with rising prices in almost all major cities and popular areas. Demand remains particularly high in tourist regions, major employment centres and their surrounding cities. This leads to price increases averaging 7.5% year-on-year, with Madrid, Valencia, Málaga and the Balearic Islands standing out with the biggest price increases.

Strong demand for housing continues, supported by stable employment and wider access to mortgages. European Central Bank interest rate cuts are making it easier to take out a mortgage, but remarkably, almost half of homes are still bought without a mortgage. This points to a significant group of buyers with a lot of equity, including foreign investors.

On the supply side, the housing market remains under pressure due to a shortage of new construction. The number of completed houses remains the same as last year, while demand is increasing. Especially in the most sought-after areas, such as Madrid and the coastal regions, this is creating additional tension in the market.

Forecast real estate market Spain 2025

Given current trends and developments, house prices are expected to continue rising in 2025, especially in major cities and popular coastal areas. The rise is likely to soften slightly as supply adjusts or demand cools somewhat due to higher prices.

For buyers, this means that finding a good property will become increasingly difficult, especially in cities like Madrid, Málaga and Valencia. Still, the market remains relatively stable, with no signs of a bubble, partly due to the good financial position of households and low risk of mortgage problems.

For investors, Spain remains an attractive market, especially in tourist areas and economically strong regions. As long as demand remains high and supply is limited, property prices here are expected to rise further.

Want to know more about investing in Spain or which regions best suit your needs? Contact us for a no-obligation consultation, at one of our offices in Spain or by phone.