Feliz 2025! A new year and a good time to analyse recent developments in the Spanish property market. We zoom in on the fourth quarter of 2024 and look back at the year in general. The upward trend in house prices continues, with remarkable growth in sought-after coastal areas such as Costa Blanca and Costa del Sol and in cities known as economic hubs, such as Madrid and Barcelona. Find out all the details in this Analysis Real Estate Market Spain 2024 Q4.

General situation real estate market Spain in 2024 Q4

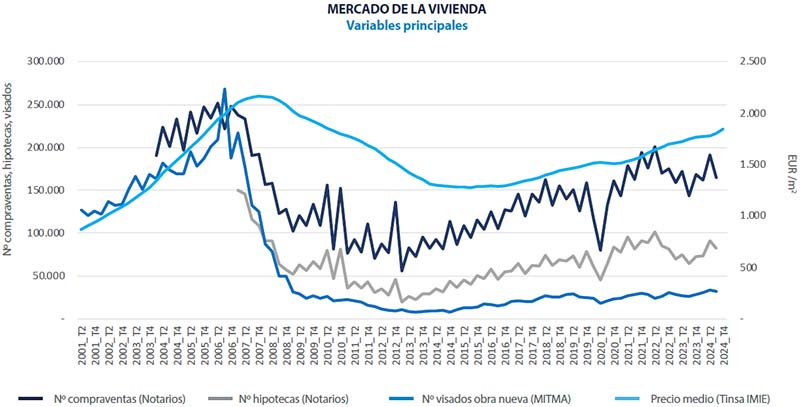

Prices of new and existing homes in Spain continued to rise in the fourth quarter of 2024. The average house price increased by 4.4% compared to last year and by 2.2% compared to the previous quarter. With this, the price increase is going slightly faster again compared to previous months.

Demand for houses remains high, partly thanks to lower mortgage interest rates as a result of eased policy by the European Central Bank. This makes it easier to get financing and stimulates the housing market. On the other hand, supply remains limited. Although the number of building permits increased by 16.5% between January and October, this is not enough to keep up with strong demand, especially in popular areas where land is becoming scarcer.

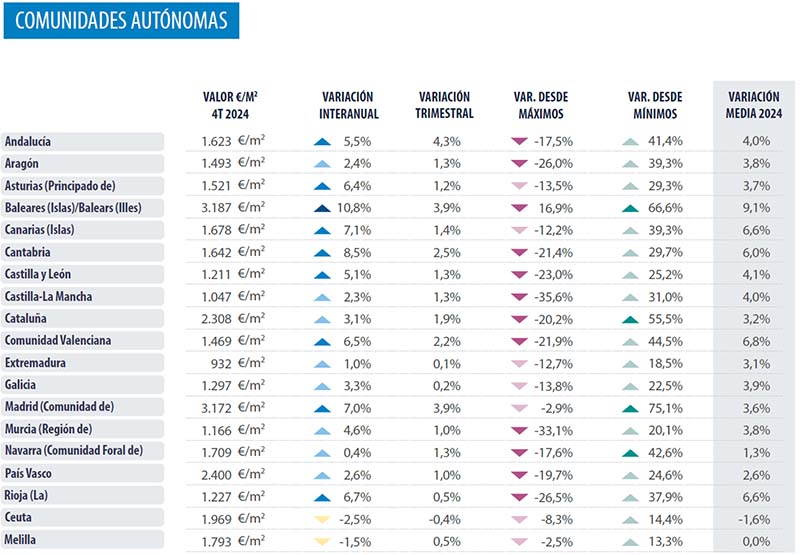

Property prices in Spain by autonomous region

Property prices show positive dynamics in almost all autonomous regions. In 13 of the 19 regions, annual price increases accelerated or remained stable. The Balearic Islands (+10.8%) and Canary Islands (+7.1%) stand out, along with urban regions such as Madrid (+7.0%) and Valencia (+6.5%), where demand remains particularly high due to a mix of local and international buyers.

On a quarterly basis, we see increases of up to 4.3% in Andalusia, 3.9% in the Balearic Islands and Madrid, and 2.2% in the Valencian region. No region recorded a significant decline.

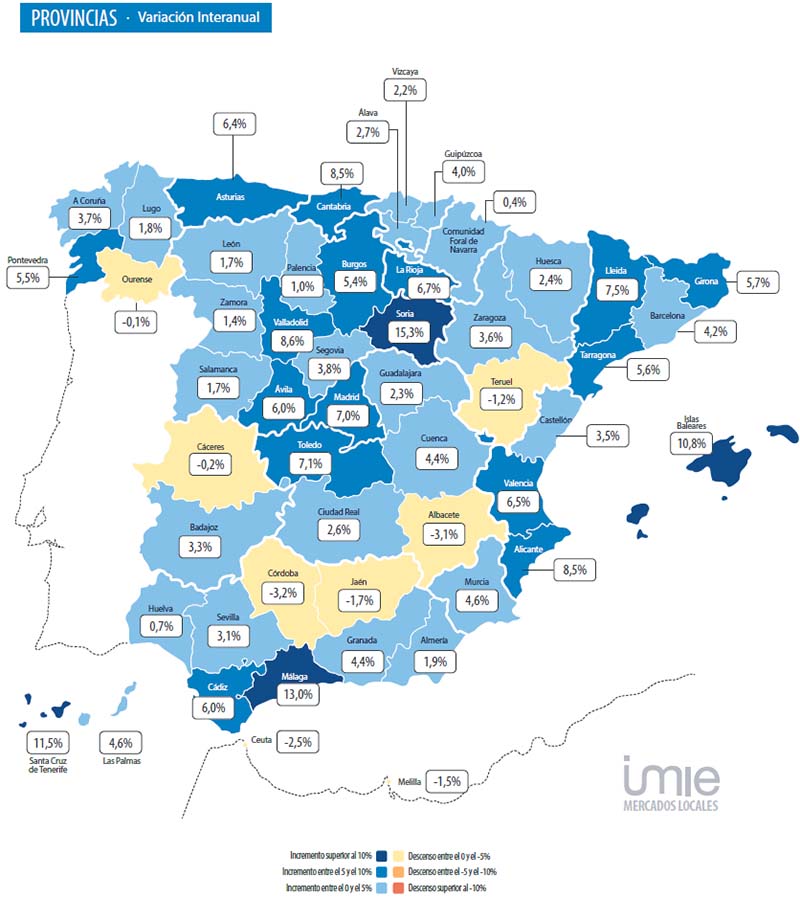

Property prices in Spain by province

At the provincial level, coastal areas and employment centres continue to lead in price increases. The largest annual increases were measured in Málaga (+13.0%), Santa Cruz de Tenerife (+11.5%) and the Balearic Islands (+10.8%). Alicante follows with growth of 8.5%.

Quarterly increases above 3% are seen in Malaga (+4.8%), Balearic Islands (+3.9%) and Madrid (+3.9%), among others. Regions such as Valencia and Seville also recorded solid 3% growth.

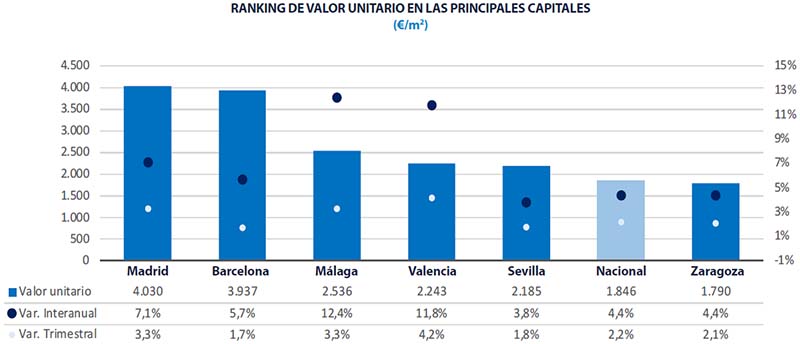

Real Estate Prices in the Major Cities of Spain

Most major cities show strong price increases, with peaks above 10% in cities such as Málaga (+12.4%), Valencia (+11.8%) and Alicante (+10.8%). These increases are due to a combination of recovering local economies, improved infrastructure and growing international interest. Palma de Mallorca and Santa Cruz de Tenerife report increases around 9%.

Employment areas such as Madrid and Barcelona show moderate growth, with +7.1% and +5.7% year-on-year, respectively. Quarterly increases in these cities remain around 1.7%.

In Valencia, we see a striking difference between the city and the province as a whole. The capital saw annual growth of 11.8%, while Valencia province remained stuck at 6.5%. This trend is repeated in other urban areas, indicating stronger demand in urbanised areas.

Conclusion real estate market Spain 2024 and forecast 2025

The fourth quarter of 2024 confirms the continued rise in house prices in Spain. The combination of strong demand, boosted by lower mortgage rates, and limited supply continues to drive up prices, especially in popular coastal areas and large cities.

The ECB is likely to cut interest rates further, making mortgages cheaper. With improved employment and increased consumer confidence, demand for housing will remain high. In doing so, Spain still remains one of the most attractive countries for foreigners to purchase a (second) home.

However, the limited availability of good homes can fuel demand, pushing prices up further in popular areas.

These dynamics make Spain an attractive market for investors. Particularly in regions such as Valencia, Málaga and the Balearic Islands, there are opportunities for those looking to benefit from price increases. This trend is expected to continue as long as housing availability lags behind demand.

Want to know more about investing in Spain or which regions best suit your needs? Contact us for a no-obligation consultation.

Source: TINSA