General situation real estate market Spain in 2022

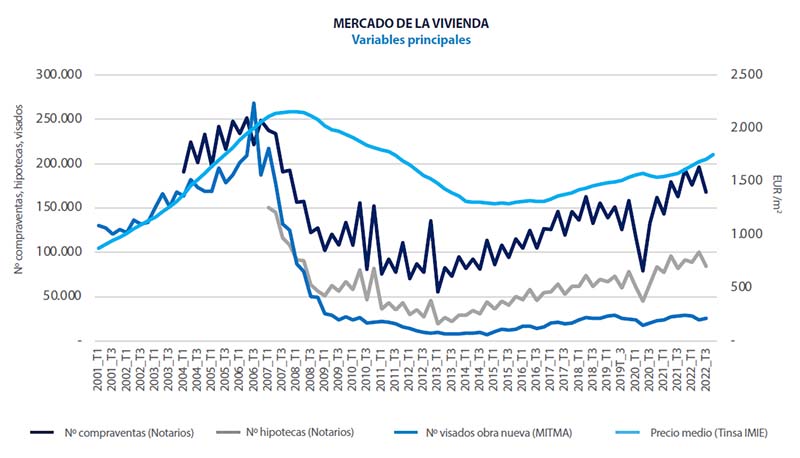

The average price of properties (new construction and existing construction) increased by 2.5% between the third and fourth quarters, bringing the year-on-year increase in the last quarter of the year to 8.8% and the average increase for all of 2022 to 8.1%. This fits well with the average inflation rate in the Spanish economy, which is around 8.5%.

As you can also see from the chart below, currently average m² prices are still not at the level they were in 2007, before the financial crisis began. However, they have been steadily on the rise since 2015. Since the “corona dip,” they have been rising every quarter, but are still attractively priced.

The chart below shows the average value per sq. ft. and you can see the annual variation.

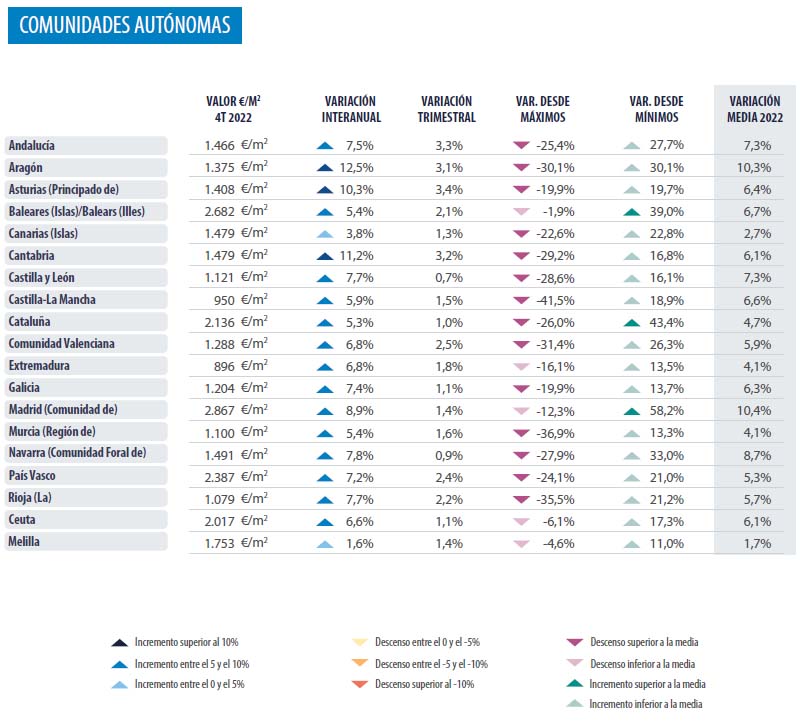

Property prices in Spain by autonomous region

All autonomous regions showed year-on-year price increases for the fifth quarter in a row. Of these, most are at an average of between 5 and 8%.

Quarterly changes remained stable, with most autonomous regions fluctuating between a 0.7 and 2% increase. House price increases in Andalusia stand out with an increase of more than 3% over the previous quarter: 3.3%.

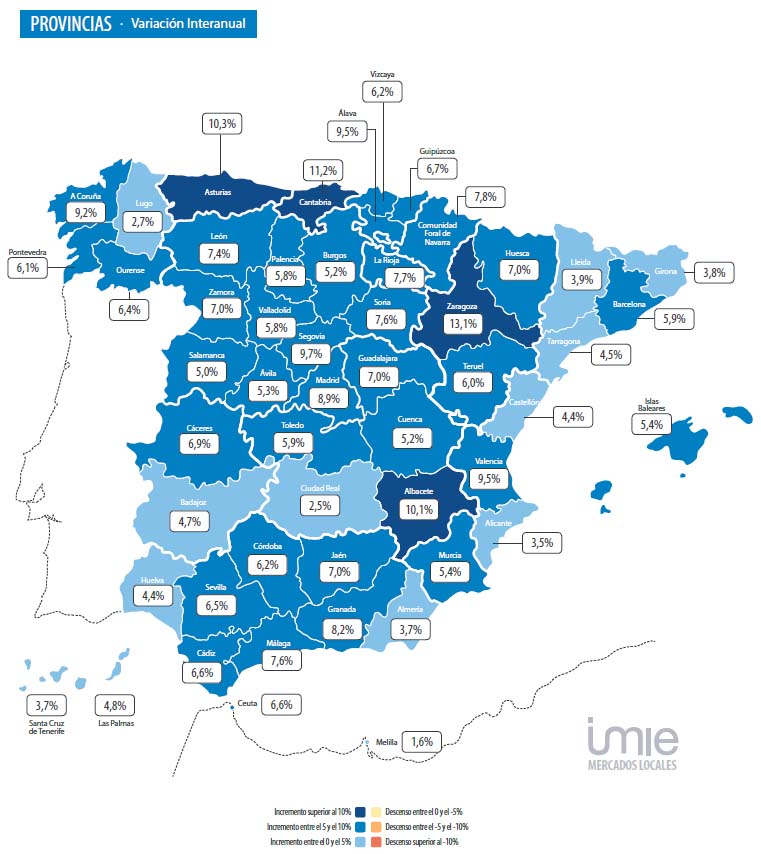

Property prices in Spain by province

Most provinces show year-on-year fluctuations between 3 and 8%. Among the capitals, Madrid increased twice as much as Barcelona in the fourth quarter: 9.2% year-on-year versus 4.7%.

As in previous quarters, in terms of square meter prices, we can report unsurprising trends among the leaders. The highest square meter prices for houses in Spain can still be found in the province of Madrid (2,867 €/m²), the Balearic Islands (2,682 €/m²) and the province of Barcelona (2,429 €/m²), all with values higher than in the previous quarter.

However, you can see that in terms of increase, the coastal provinces of Valencia, Granada and Malaga show the largest increases.

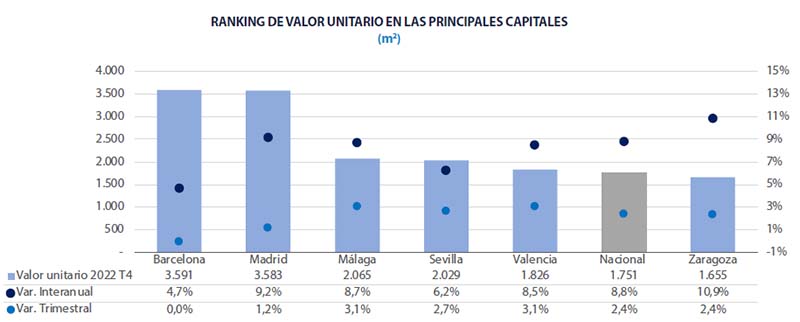

Real estate prices in Spain's main capitals

In the fourth quarter, average house prices for most capitals increased between 3% and 6% year-on-year. Barcelona remained level compared to the third quarter (+0.0%). With an annual increase of 4.3%, Barcelona is growing half as fast as Madrid and it is the only one of the six major capitals where house prices increased by less than 6% over the past year.

Cities where year-on-year house price increases are keeping up nicely with Spain’s average are Valencia (8.5%) and Malaga (8.7%).

Forecast property market Spain 2023

Experts expect inflation to have some impact on the demand for real estate. Nevertheless, the inflationary climate may actually encourage the investment of savings in real estate, so that sales and purchases do not fall, but remain at a level close to that of last year. Moreover, we see that properties in Spain are more popular than ever in Spain in this article foreigners are buying more and more expensive homes in Spain.

Even though in general there are many houses for sale throughout Spain, the offer what is suitable for foreigners is limited. A good house or a nice plot of land in the popular areas such as the Costa’s and big cities, which is to the taste of the foreign buyer, remains limited. This will keep pressure on the price. In short, even in these times of inflation and with the increased desire for (temporary) living in Spain, Spain remains a good investment option. Investing in bricks is always good and there are still good opportunities.

Want more advice on investing in Spanish real estate, or hear our advice on the different regions? Then contact us now and we will be happy to tell you more about the possibilities.

Source: Tinsa